According to information collated with the support of ReFuelEU Aviation Member State Network

), established by EASA to support the implementation of the Regulation, the current annual SAF production capacity in the EU is just above 1 million tonnes (Mt). Almost all this SAF production is HEFA and does not account for co-processing production using sustainable feedstock in fossil fuel plants, for which there is not enough reliable information. This could be considered to be an

‘operating scenario’.If facilities that are currently under construction are taken into account, the amount of SAF production capacity in 2030 could reach 3.5 Mt. This could be considered a ‘realistic scenario’. Again, almost all this production would be dominated by the HEFA production pathway and does not include any Power-to-Liquid (PtL) production, as no plant has yet evolved beyond a pilot stage. Other studies come to different conclusions, mostly due to a different set of assumptions and methodologies. The recent SkyNRG Market Outlook from June 2024

[34]

estimates 3.8 Mt by 2030, including 0.3 Mt of PtL as well as some co-processing production, while the International Energy Agency (IEA) predicts roughly 3.8 Mt by 2038

[35]

. In both cases, a significant acceleration in the construction of PtL plants will be needed to meet the first sub-mandate of 0.7% in 2030.

In addition to the operating and realistic scenarios, both the ReFuelEU Aviation Member State Network and the SkyNRG Market Outlook collected information to build up an ‘optimistic scenario’. This includes all projects in the pipeline to be in operation by 2030 and includes PtL projects, leading to a projected SAF capacity of 5.6 Mt and 5.5 Mt respectively.

illustrates all of the above scenarios out to 2030, including the capacity from co-production. While the realistic scenario (3.2 Mt) would be able to meet the projected demand of the 6% mandate by 2030 (2.8 Mt), significant growth in production capacity is required to fulfil the very ambitious ramp-up to 20% in the subsequent 2030-2035 period.

Beyond 2030, projections of production capacity are more challenging and the potential SAF production will depend on the availability of feedstocks (eg. HEFA, green hydrogen, renewable energy). The aviation industry will be competing with other sectors as part of the economy wide decarbonization efforts where these feedstocks could be used to directly decarbonize the primary energy supply. As a result, securing these sources of renewable energy will be critical to ensure the ramp-up of PtL SAF production within Europe. There are positive signals in particular from the solar industry, where the growth of global installation capacity is accelerating faster than anticipated and becoming the largest source of new electricity, with solar capacity doubling every three years and hence growing ten-fold every decade

[36]

. Overall, renewable energy passed 30% of the total global energy supply for the first time in 2023

[37]

. By the 2030s, solar energy is likely to become the biggest source of electrical power and by the 2040s it may be the largest source of all energy

[36]

.

Another limiting factor for SAF deployment towards 2050 is the capital expenditure required to build the production facilities. It is estimated that between 500- 800 SAF facilities10 will be needed globally by 2050, which, assuming €1.8 billion per facility, would result in around €36 billion capital expenditure annually between 2025 and 2050

[34]

.

Estimations of the future SAF landscape have concluded that indeed PtL fuels have the potential to cover 50% of the global SAF production capacity by 2050. Whereas HEFA production will be around 7% and AtJ / FT the remaining 43%. Projections by region also highlight the varying availabilities for feedstocks in the different parts of the world

[38]

.

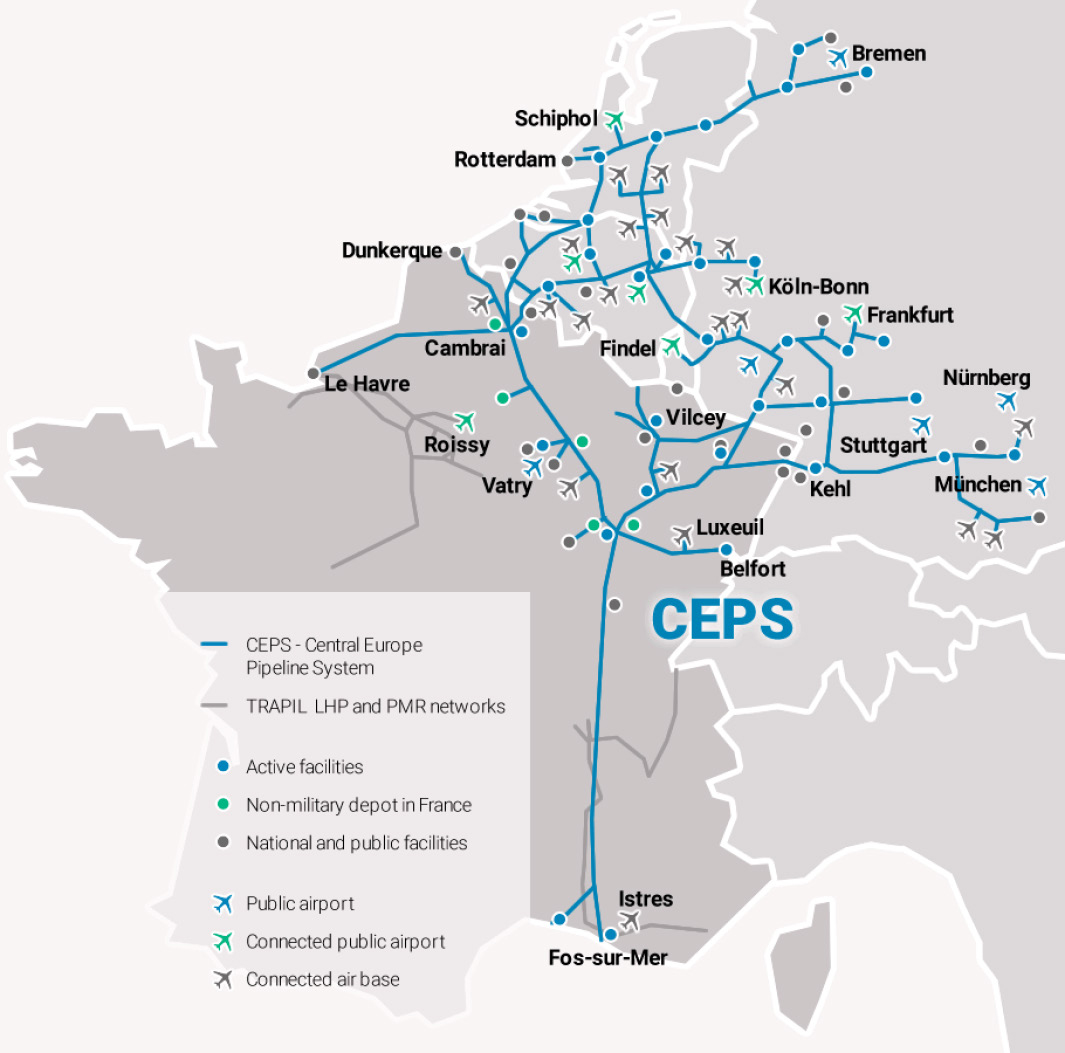

System (CEPS)

System (CEPS)  acturer ATR, Swedish airline Braathens Regional Airlines and Neste collaborated to enable the first ever 100% SAF- powered test flight on a commercial regional aircraft. The flight took place in Sweden in July 2022 and is part of the 100% sustainable aviation fuel (SAF) certification process of ATR aircraft that started in September 2021. The test flight further supports aviation’s decarbonisation targets and acceleration of SAF certification.

acturer ATR, Swedish airline Braathens Regional Airlines and Neste collaborated to enable the first ever 100% SAF- powered test flight on a commercial regional aircraft. The flight took place in Sweden in July 2022 and is part of the 100% sustainable aviation fuel (SAF) certification process of ATR aircraft that started in September 2021. The test flight further supports aviation’s decarbonisation targets and acceleration of SAF certification.

ight 100 flew on 100% SAF from London to New York, marking the culmination of a year of collaboration to demonstrate the capability of SAF as a safe drop- in replacement for fossil derived jet fuel that is compatible with today’s engines, airframes, and fuel infrastructure. Flown on a Boeing 787, using Rolls-Royce Trent 1000 engines, the flight marked a world first on 100% Drop-In SAF by a commercial airline across the Atlantic. The SAF used was 88% HEFA (Hydroprocessed Esters and Fatty Acids) made from waste fats and 12% SAK (Synthetic Aromatic Kerosene) made from plant sugars. It is estimated that the use of SAF reduced nvPM emissions by 40% and CO2 emissions by 64%, as well as an overall improvement in fuel burn efficiency as the SAF produced 1% more energy compared to the same mass of fossil fuel.

ight 100 flew on 100% SAF from London to New York, marking the culmination of a year of collaboration to demonstrate the capability of SAF as a safe drop- in replacement for fossil derived jet fuel that is compatible with today’s engines, airframes, and fuel infrastructure. Flown on a Boeing 787, using Rolls-Royce Trent 1000 engines, the flight marked a world first on 100% Drop-In SAF by a commercial airline across the Atlantic. The SAF used was 88% HEFA (Hydroprocessed Esters and Fatty Acids) made from waste fats and 12% SAK (Synthetic Aromatic Kerosene) made from plant sugars. It is estimated that the use of SAF reduced nvPM emissions by 40% and CO2 emissions by 64%, as well as an overall improvement in fuel burn efficiency as the SAF produced 1% more energy compared to the same mass of fossil fuel.