Analysis scope and assumptions

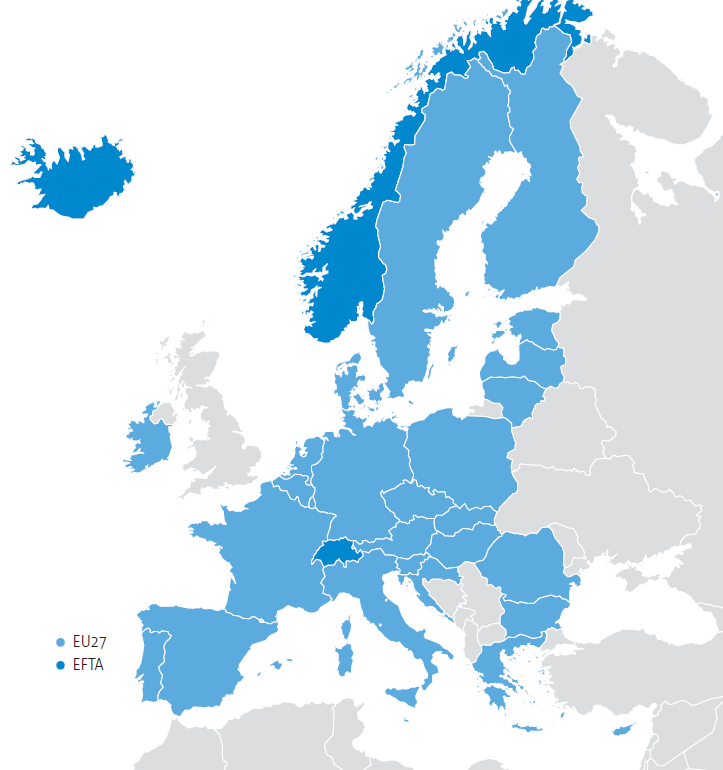

Historical air traffic data in this section comes from Eurostat and EUROCONTROL. The coverage is all flights from or to airports in the European Union (EU27)10 and European Free Trade Association (EFTA). The forecast of European flights comes from the EUROCONTROL Aviation Outlook11 (EAO)

. For more details on models, analysis methods, forecasts, supporting data sources and assumptions used in this section, please refer to Appendix C.10 The geographical scope is constant through the entire time period covered in this Chapter. Consequently, the data does not include UK for those years preceding Brexit.

11 The EAO was prepared before the start of the invasion of Ukraine by Russia. At the time of writing, the impact on traffic is high for some States adjacent to Belarus, Russian and Ukraine. However, the overall impact on the full European network remains relatively small. The focus of the EAO is 2050.